The rate of return (RoR) is a measure of how much an investment has gained or lost over a certain period of time, relative to its initial cost. It is usually expressed as a percentage of the original investment.

The rate of return can be applied to any type of investment, such as stocks, bonds, real estate, or art. However, the calculation of the rate of return may vary depending on the type of investment, the time period, and the cash flows involved.

For stocks, the rate of return is calculated by taking the difference between the current value and the initial value of the stock, and adding any dividends received during the holding period. Then, the result is divided by the initial value of the stock, and multiplied by 100 to get the percentage.

For stock indexes, the rate of return is calculated by taking the difference between the starting and ending values of the index, and dividing it by the starting value of the index, and multiplying by 100 to get the percentage.

The rate of return can be used to compare the performance of different investments or to evaluate the performance of a portfolio against a benchmark. However, the rate of return does not take into account the effects of inflation, taxes, fees, or the time value of money. Therefore, other measures, such as the real rate of return, the after-tax rate of return, or the internal rate of return, may be more appropriate for some situations.

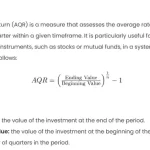

Basic Theory:

The rate of return (RoR) is a key financial metric that measures the profitability of an investment over a specified period. It is expressed as a percentage and provides insights into the performance and profitability of a particular investment. The basic formula for calculating the rate of return is:

This formula compares the change in value over time relative to the initial investment.

Procedures:

To calculate the rate of return for stocks or stock indexes in Excel, follow these steps:

- Gather Data: Collect the beginning and ending values of the investment (stock or stock index) for the desired period.

- Use Excel Formulas: Apply the rate of return formula in an Excel cell using the following syntax:

=((Ending Value - Beginning Value) / Beginning Value) * 100

Comprehensive Explanation:

Let’s consider a scenario where an investor purchases 100 shares of XYZ Company at $50 per share at the beginning of the year. At the end of the year, the stock price has increased to $60 per share.

| Year | Beginning Value | Ending Value |

|---|---|---|

| 2023 | $5,000 | $6,000 |

Using the rate of return formula:

Scenario Calculation:

- Gather Data:

- Beginning Value: $5,000

- Ending Value: $6,000

- Use Excel Formula:

- In an Excel cell, input:

=((6000-5000)/5000)*100

- In an Excel cell, input:

The result will be 20%, indicating a 20% return on the investment over the year.

Other Approaches:

- Time-Weighted Rate of Return (TWR): TWR adjusts for the impact of external cash flows, providing a more accurate measure for investors who regularly contribute to or withdraw from their portfolios.

- Geometric Mean Return: Geometric mean return is useful for evaluating the average rate of return over multiple periods, considering compounding effects.

- Using Excel Functions: Excel offers functions like

RATEandXIRRfor more complex scenarios involving irregular cash flows.