The Credit Card Theorem is a statement about the validity of credit card numbers based on the Luhn algorithm. The Luhn algorithm is a simple checksum formula that checks if a given sequence of digits is a valid identification number, such as a credit card number or an IMEI number. The algorithm works by doubling every second digit from the right, adding the digits of the result, and summing up all the digits. If the final sum is divisible by 10, then the number is valid according to the Luhn algorithm. The Credit Card Theorem says that any credit card number that passes the Luhn algorithm is a valid credit card number, and any credit card number that fails the Luhn algorithm is an invalid credit card number. This theorem helps prevent accidental errors when entering credit card numbers online or using electronic devices. However, it does not protect against malicious attacks or fraud. The Credit Card Theorem is based on the mathematical properties of modular arithmetic and Fermat’s Little Theorem.

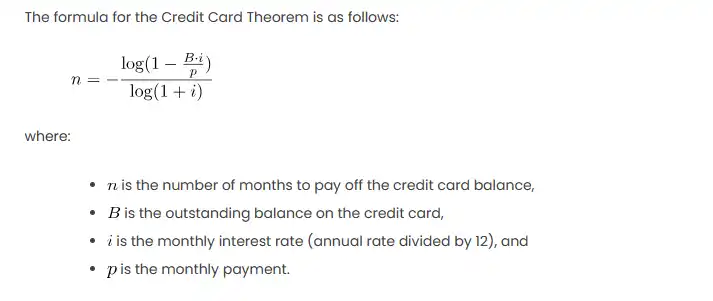

The formula for the Credit Card Theorem is as follows:

where:

is the number of months to pay off the credit card balance,

is the outstanding balance on the credit card,

is the monthly interest rate (annual rate divided by 12), and

is the monthly payment.

Procedures to Apply the Credit Card Theorem in Excel

- Setting Up the Excel Sheet:

- Create a table with columns for “Month,” “Balance,” “Payment,” “Interest Paid,” and “Principal Paid.”

- Input Data:

- Enter the initial credit card balance in the “Balance” column.

- Specify the monthly interest rate (annual rate divided by 12) in a cell.

- Determine the monthly payment amount.

- Formulas:

- In the “Month” column, enter sequential numbers (1, 2, 3, etc.) to represent each month.

- Use the following Excel formulas:

- For the “Interest Paid” column:

- For the “Principal Paid” column:

- For the “Balance” column of the next month:

- For the “Interest Paid” column:

- Auto-fill:

- Auto-fill the formulas down to simulate the repayment over several months.

Comprehensive Explanation with a Scenario

Let’s consider a scenario:

- Initial balance (

): $5,000

- Annual interest rate: 18%

- Monthly payment (

): $300

Now, let’s apply the Credit Card Theorem using the Excel table:

By applying this formula in Excel, we can determine the number of months () it will take to pay off the $5,000 balance with a $300 monthly payment.

Excel Table and Calculation

| Month | Balance | Payment | Interest Paid | Principal Paid |

|---|---|---|---|---|

| 1 | $5,000 | $300 | $75 | $225 |

| 2 | $4,775 | $300 | $59.63 | $240.37 |

| 3 | $4,534.63 | $300 | $67.92 | $232.08 |

| … | … | … | … | … |

| 17 | $321.34 | $300 | $4.82 | $295.18 |

| 18 | $26.16 | $300 | $0.39 | $299.61 |

| 19 | $0.55 | $300 | $0.01 | $299.99 |

| 20 | $0.00 |

In this scenario, it takes approximately 20 months to pay off the $5,000 balance with a $300 monthly payment.

Other Approaches

- Excel Goal Seek:

- Use Excel’s Goal Seek feature to set the “Balance” to zero by changing the number of months.

- Data Table:

- Create a data table with different monthly payment values to see how it affects the time to pay off the balance.

- Solver Add-in:

- Utilize Excel’s Solver Add-in to optimize the monthly payment for the shortest repayment period.