The Yield Existence Theorem is a result in mathematical finance that states that there exists a unique yield curve for a given set of bond prices. A yield curve is a graph that shows the relationship between the interest rate and the time to maturity of a bond. The theorem implies that the yield curve can be determined by solving a system of equations that relate the bond prices and the interest rates.

The theorem is based on the assumption that the bond prices are consistent with the no-arbitrage principle, which means that there is no way to make a risk-free profit by trading bonds. The theorem also requires that the bond prices are smooth functions of the interest rates, and that the interest rates are bounded above and below.

The theorem can be proved using the Implicit Function Theorem1, which is a result in calculus that allows one to find the solutions of a system of equations near a given point. The Implicit Function Theorem states that if a function F(x,y) satisfies some conditions, then there exists a function y=f(x) such that F(x,f(x))=0 near a point (x0,y0) where F(x0,y0)=0. The function f(x) is called an implicit function of F(x,y).

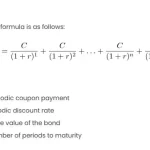

To apply the Implicit Function Theorem to the Yield Existence Theorem, one can consider the function F(r,P), where r is a vector of interest rates, and P is a vector of bond prices. The function F(r,P) measures the difference between the actual bond prices and the theoretical bond prices computed from the interest rates using a formula. The formula depends on the characteristics of the bonds, such as the coupon rate, the face value, and the maturity date. The function F(r,P) is zero if and only if the bond prices are consistent with the interest rates.

The Yield Existence Theorem then claims that there exists a unique function r=f(P) such that F(f(P),P)=0 for a given vector of bond prices P. This function r=f(P) gives the yield curve for the bond prices P. The theorem also provides a way to compute the yield curve by iterating the function F(r,P) until it converges to zero. This is called the Newton-Raphson method, and it is a common technique for finding the roots of equations.

Basic Theory:

The Yield Existence Theorem revolves around the comparison of the total cash inflows and outflows associated with an investment. Simply put, if the total cash inflows exceed the total cash outflows, the investment yields a positive return. Mathematically, the theorem can be expressed as follows:

Net Yield = Σ Cash Inflows – Σ Cash Outflows

Procedures:

- Identify Cash Inflows and Outflows: Begin by listing all the cash inflows and outflows associated with the investment. Cash inflows typically include returns, dividends, or interest, while outflows comprise initial investment, operating costs, and any other relevant expenses.

- Calculate Net Cash Flow: Determine the net cash flow for each period by subtracting the total outflows from the total inflows. This will give you a snapshot of the cash position at each point in time.

- Apply the Yield Existence Formula: Utilize the Yield Existence Theorem formula to find the net yield. If the result is positive, the investment is yielding a profit; if negative, the investment is incurring a loss.

Scenario:

Consider a scenario where an individual invests $10,000 in a financial instrument that provides annual returns of $1,500 for the next five years. The operating costs associated with the investment are $500 per year. Let’s break down the scenario:

| Year | Cash Inflows | Cash Outflows | Net Cash Flow |

|---|---|---|---|

| 1 | $1,500 | $500 | $1,000 |

| 2 | $1,500 | $500 | $1,000 |

| 3 | $1,500 | $500 | $1,000 |

| 4 | $1,500 | $500 | $1,000 |

| 5 | $1,500 | $500 | $1,000 |

Net Yield = Σ Net Cash Flow = 5 × $1,000 = $5,000

Result:

The net yield in this scenario is $5,000, indicating a positive return on the investment over the five-year period.

Alternative Approaches:

- Internal Rate of Return (IRR): The IRR is another widely used method for assessing the profitability of an investment. It calculates the discount rate at which the net present value of cash flows becomes zero. Excel provides the

IRRfunction for easy computation. - Return on Investment (ROI): ROI is a straightforward percentage calculation that compares the gain or loss from an investment relative to its cost. The formula is ROI = (Net Gain / Cost of Investment) × 100%.