Treasury Bills, or T-Bills, are short-term debt securities issued by the U.S. government. They have maturities of one year or less, and are sold at a discount from their face value. The difference between the purchase price and the face value is the interest earned by the investor. T-Bills are considered very safe and liquid investments, as they are backed by the full faith and credit of the U.S. government. They also have the advantage of being exempt from state and local income taxes, although they are subject to federal income taxes.

T-Bills are sold through auctions, where investors can place competitive or non-competitive bids. Competitive bids specify the desired yield or discount rate, and the amount of T-Bills to buy. Non-competitive bids specify only the amount of T-Bills to buy, and accept the average yield or discount rate of the competitive bids. The Treasury Department allocates the T-Bills to the bidders based on the highest yields or lowest prices. The minimum purchase amount is $100, and the maximum purchase amount is $10 million for non-competitive bids, and 35% of the offering amount for competitive bids.

T-Bills are classified by their maturity dates, which range from four weeks to 52 weeks. The Treasury Department issues T-Bills every week for the four, eight, 13, 17, and 26-week maturities, and every four weeks for the 52-week maturity. The Treasury Department also issues Cash Management Bills (CMBs) at irregular intervals and for variable terms, to meet the temporary cash needs of the government. CMBs are only available through banks, brokers, or dealers, and not through TreasuryDirect, the online platform for buying and selling Treasury securities.

T-Bills are suitable for investors who are looking for a low-risk, short-term, and highly liquid investment. They can also be used for hedging, diversifying, or balancing a portfolio. However, T-Bills also have some drawbacks, such as low returns, reinvestment risk, and inflation risk. T-Bills offer lower yields than other types of bonds or stocks, as they reflect the prevailing interest rates and the low credit risk of the U.S. government. T-Bills also expose investors to the risk of changing interest rates, which affect the price and yield of the T-Bills in the secondary market. Additionally, T-Bills are subject to the risk of losing purchasing power due to inflation, which erodes the real value of the interest income.

Basic Theory

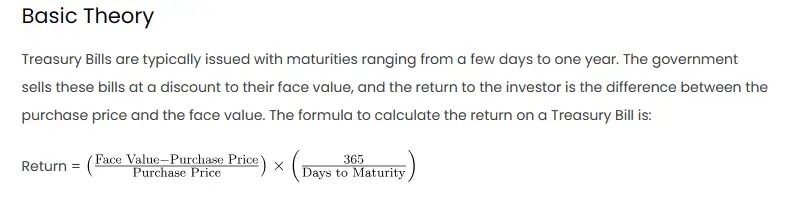

Treasury Bills are typically issued with maturities ranging from a few days to one year. The government sells these bills at a discount to their face value, and the return to the investor is the difference between the purchase price and the face value. The formula to calculate the return on a Treasury Bill is:

Return =

Procedures

- Identify T-Bill Details:

- Face Value (FV): The nominal value of the Treasury Bill.

- Purchase Price (PP): The price at which the investor buys the T-Bill.

- Days to Maturity (DM): The number of days until the T-Bill matures.

- Apply the Formula:

- Use the formula mentioned earlier to calculate the return.

Excel Formulas

Let’s break down the Excel formulas for each component:

= ((FV - PP) / PP) * (365 / DM)Scenario: Real Numbers

Let’s consider a scenario:

- Face Value (FV): $10,000

- Purchase Price (PP): $9,800

- Days to Maturity (DM): 90 days

Apply the formula:

= (($10,000 - $9,800) / $9,800) * (365 / 90)Excel Table

| Face Value | Purchase Price | Days to Maturity | Return |

|---|---|---|---|

| $10,000 | $9,800 | 90 | [Result] |

Result

The result of the scenario is the return on the Treasury Bill, calculated using the Excel formula. Copy the formula in the “Return” column to get the numerical result.

Other Approaches

- Yield Function:Excel provides a YIELD function for T-Bill calculations. For our scenario:

=YIELD(DM,0,FV,PP,1,2) - IRR Function:Another approach is to use the IRR function, considering the T-Bill as a cash flow:

=IRR([-PP, FV], DM/365)

These functions can provide the same result and may be more convenient in some situations.