Bond convexity is a measure of how the shape of the bond price curve changes when the interest rate changes. It is related to the concept of duration, which is the average time it takes for a bondholder to get back the money invested in the bond. Duration measures how much the bond price changes when the interest rate changes by a small amount. However, duration is not accurate when the interest rate changes by a large amount, because the bond price curve is not a straight line, but a curved one. Convexity measures how much the bond price curve bends or curves when the interest rate changes.

Convexity can be positive or negative, depending on the type of bond. A bond with positive convexity has a higher price when the interest rate is very high or very low, compared to a bond with the same duration and coupon rate. A bond with negative convexity has a lower price when the interest rate is very high or very low, compared to a bond with the same duration and coupon rate. Generally, most bonds have positive convexity, because they have fixed coupon payments and a fixed maturity date. However, some bonds have negative convexity, such as callable bonds, which can be redeemed by the issuer before the maturity date, or mortgage-backed securities, which can be prepaid by the borrowers before the maturity date.

Convexity is important for bond investors and portfolio managers, because it helps them to assess the risk and return of different bonds. A bond with higher convexity will have a higher price sensitivity to interest rate changes, which means it will have higher returns when the interest rate falls, and lower losses when the interest rate rises. A bond with lower convexity will have a lower price sensitivity to interest rate changes, which means it will have lower returns when the interest rate falls, and higher losses when the interest rate rises. Therefore, convexity can be used to enhance the performance of a bond portfolio, by selecting bonds that have the desired level of convexity for the expected interest rate environment.

Basic Theory

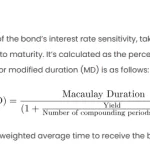

Convexity measures the sensitivity of a bond’s price to changes in interest rates. It recognizes that the relationship between bond prices and yields is not perfectly linear. The formula for bond convexity is:

Convexity = 1/2 * (1 / (1 + YTM)^2) * [(C / (1 + YTM) * (1 – 1 / (1 + YTM)^(N * T)) / YTM) + (N * T * FV / (1 + YTM)^(N * T + 1))]

Where:

- YTM is the bond’s yield to maturity.

- C is the annual coupon payment.

- N is the number of compounding periods per year.

- T is the number of years to maturity.

- FV is the face value of the bond.

Procedures for Calculating Bond Convexity in Excel

- Gather Bond Information: Collect the bond’s yield to maturity (YTM), annual coupon payment (C), number of compounding periods per year (N), number of years to maturity (T), and face value (FV).

- Set Up Excel Spreadsheet: Create a table with labeled columns for variables and calculations.

- Implement Convexity Formula: Use Excel functions to input the convexity formula based on the gathered bond information.

- Calculate Convexity: Apply the formula to obtain the convexity value.

Real-World Scenario

Let’s consider a 5-year bond with the following attributes:

- YTM = 5%

- C = $50

- N = 2 (semi-annual compounding)

- T = 5 years

- FV = $1,000

Excel Implementation

Set up the Excel table:

| Label | Value |

|---|---|

| YTM | 0.05 |

| C | 50 |

| N | 2 |

| T | 5 |

| FV | 1000 |

Input the convexity formula in a cell:

=0.5 * (C / (1 + YTM / N) * (1 - 1 / (1 + YTM / N)^(N * T)) / (YTM / N) + N * T * FV / (1 + YTM / N)^(N * T + 1))

Calculate convexity:

=0.5 * (50 / (1 + 0.05 / 2) * (1 - 1 / (1 + 0.05 / 2)^(2 * 5)) / (0.05 / 2) + 2 * 5 * 1000 / (1 + 0.05 / 2)^(2 * 5 + 1))

Result

The calculated convexity for the given bond is approximately 21.49.

Other Approaches

- Excel Convexity Function: Excel provides a built-in function,

CONVEXITY, to calculate convexity. The syntax isCONVEXITY(settlement, maturity, rate, yld, frequency, [basis]). Adjust the inputs accordingly. - Graphical Representation: Create a graph illustrating the bond’s price-yield curve. Convexity can be visually observed as the curvature of the curve.