Amortization periodic payments are the fixed amounts that a borrower pays to a lender at regular intervals to repay a loan that is amortized. Amortization is the process of spreading out the loan payments over time, so that each payment covers both the interest and the principal of the loan. The interest portion of each payment is calculated based on the remaining balance of the loan, while the principal portion is the difference between the total payment and the interest portion. As the loan balance decreases, the interest portion also decreases, and the principal portion increases. This means that the borrower pays less interest and more principal over time, until the loan is fully paid off.

Basic Theory

Amortization is a financial concept that involves the gradual repayment of a loan or debt over a specified period. In the context of periodic payments, it refers to the systematic reduction of the outstanding balance through equal installment payments. Excel provides powerful tools to calculate amortization schedules, making it easier for businesses and individuals to understand their loan repayment structure.

Procedures

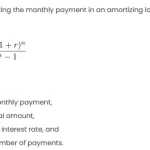

The basic formula for calculating periodic payments in an amortization schedule is the PMT function in Excel. The PMT function takes into account the interest rate, number of periods, and loan amount to determine the regular payment required to fully repay the loan over its term.

The formula for calculating periodic payments (PMT) is as follows:

=PMT(interest_rate/number_of_periods, number_of_periods, -loan_amount)

Explanation

Let’s break down the components of the formula:

- Interest Rate: The annual interest rate for the loan.

- Number of Periods: The total number of payment periods over the loan term.

- Loan Amount: The principal amount of the loan.

The result of the PMT function will be the periodic payment required to fully amortize the loan. This payment includes both principal and interest components.

Scenario with Real Numbers

Let’s consider a scenario:

- Loan Amount: $50,000

- Annual Interest Rate: 5%

- Loan Term (Number of Periods): 3 years (36 months)

Now, we can input these values into the PMT formula in Excel:

=PMT(5%/12, 36, -50000)

The result of this calculation will be the monthly payment required to amortize the loan under the given conditions.

Using the provided scenario, the calculated monthly payment is approximately $1,507.58.

Alternative Approaches

While the PMT function is a straightforward way to calculate periodic payments, Excel offers additional functions such as PPMT and IPMT, which allow you to separately calculate the principal and interest portions of each payment. These functions provide more detailed insights into the loan repayment structure.