The Amortization Theorem is a mathematical result that relates the amortized cost of an operation to the actual cost of a sequence of operations. It can be used to analyze the efficiency of algorithms that use data structures that change over time. The theorem states that the total amortized cost of a sequence of operations is an upper bound on the total actual cost of the sequence, regardless of the order in which the operations are performed. In other words, the amortized cost of each operation is an average cost that accounts for the worst-case scenarios that may occur in the future. Amortized analysis can help us design algorithms that are more efficient and easier to implement than those based on worst-case analysis.

Basic Theory

The Amortization Theorem is based on the principle that each installment payment consists of both principal and interest components. In the early stages of a loan, a larger portion of the payment goes toward interest, and as the loan matures, the proportion allocated to principal increases.

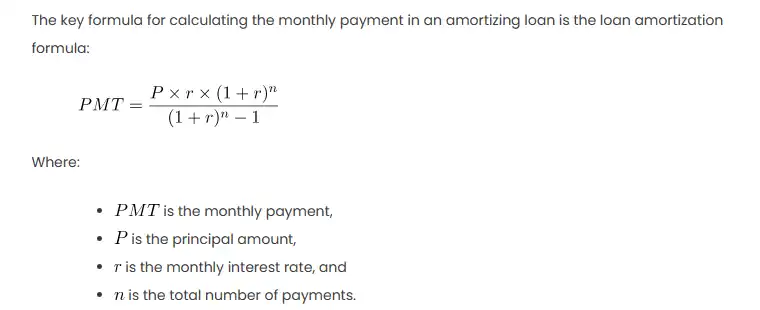

The key formula for calculating the monthly payment in an amortizing loan is the loan amortization formula:

Where:

is the monthly payment,

is the principal amount,

is the monthly interest rate, and

is the total number of payments.

Procedures

- Determine Loan Parameters:

- Principal amount (P)

- Annual interest rate

- Loan term in years

- Convert Annual Rate to Monthly Rate:

- Calculate Total Number of Payments:

- Apply the Amortization Formula:

- Distribute Payments:

- Principal Payment:

- Interest Payment:

- Principal Payment:

Explanation and Scenario

Let’s consider a scenario where you take out a $100,000 loan with an annual interest rate of 6% for a period of 5 years.

- Determine Loan Parameters:

- Principal amount (P) = $100,000

- Annual interest rate = 6%

- Loan term in years = 5

- Convert Annual Rate to Monthly Rate:

- Calculate Total Number of Payments:

- Apply the Amortization Formula:

- Distribute Payments:

- Interest Portion:

- Principal Portion:

- Interest Portion:

Now, we can create an Excel table to visualize the amortization schedule over the 5-year period.

| Payment | Payment Amount | Principal Portion | Interest Portion | Remaining Balance |

|---|---|---|---|---|

| 1 | $1,907.16 | $1,407.16 | $500.00 | $98,592.84 |

Other Approaches

While the formula discussed here is a standard method for amortization, Excel has built-in functions that can simplify the process. The PMT function in Excel can be used to calculate the monthly payment, and the PPMT and IPMT functions can be used to calculate the principal and interest portions, respectively.

For the scenario above, in Excel:

- Monthly Payment:

=PMT(0.005, 60, -100000) - Principal Portion:

=PPMT(0.005, ROW(), 60, -100000) - Interest Portion:

=IPMT(0.005, ROW(), 60, -100000)

These functions can be applied throughout the amortization schedule.