An ordinary annuity is a financial arrangement characterized by a series of equal cash flows or payments made at regular intervals, with the payments occurring at the end of each period. This type of annuity is commonly encountered in various financial scenarios, such as loan repayments or investment plans. Unlike an annuity due, where payments are made at the beginning of each period, in an ordinary annuity, payments are made at the end of each period. The fundamental concept revolves around the idea of consistently investing or receiving funds over time, with the expectation that these periodic payments, when compounded at a certain interest rate, will accumulate to a significant future value. Ordinary annuities are widely used in financial planning, and understanding their dynamics is crucial for individuals and businesses in making informed decisions regarding loans, investments, or retirement planning.

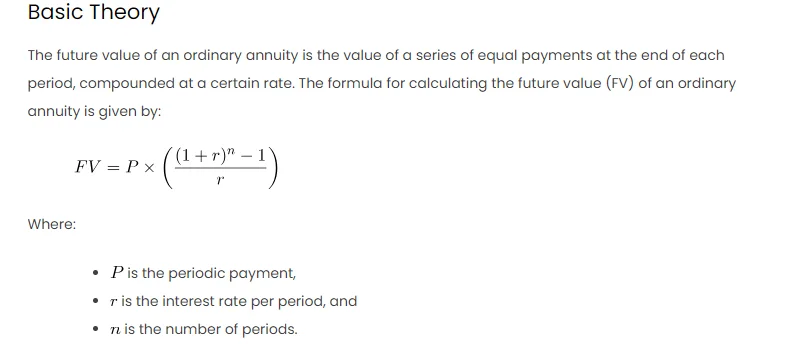

Basic Theory

The future value of an ordinary annuity is the value of a series of equal payments at the end of each period, compounded at a certain rate. The formula for calculating the future value (FV) of an ordinary annuity is given by:

Where:

is the periodic payment,

is the interest rate per period, and

is the number of periods.

Procedures in Excel

To calculate the future value of an ordinary annuity in Excel, you can use the formula mentioned above. Follow these steps:

- Open Excel: Open a new or existing Excel worksheet.

- Enter Data: In a column, enter the periodic payment (

), interest rate per period (

), and the number of periods (

).

- Use Formula: In a cell, use the formula to calculate the future value. For example, if your payment is in cell A1, interest rate in A2, and number of periods in A3, enter the following formula in another cell:

=A1 * ((1 + A2)^A3 - 1) / A2

- Press Enter: Press Enter to get the result.

Scenario

Let’s consider a scenario where you invest $1,000 at the end of each year for 5 years with an annual interest rate of 8%. We want to calculate the future value of this ordinary annuity.

Excel Table

| Periodic Payment | Interest Rate | Number of Periods | Future Value |

|---|---|---|---|

| $1,000 | 8% | 5 | [Formula Result] |

Calculation

- Enter Data: Input $1,000 in cell B2, 8% in B3, and 5 in B4.

- Use Formula: In another cell, use the formula:

=B2 * ((1 + B3)^B4 - 1) / B3

- Press Enter: The result will be the future value of the annuity.

Result

The future value of the ordinary annuity is approximately $5,866.18.

Other Approaches

- Excel Functions: Excel provides functions like

FVthat can directly calculate the future value of an annuity. For the scenario above, you could use the following formula:

=FV(B3, B4, 0, -B2, 0)

- Data Tables: You can use Excel’s Data Table feature to create a table of multiple scenarios by changing the interest rate and number of periods.