Simple interest is a way of calculating the interest earned or paid on a loan or deposit without compounding it. This means that the interest is always based on the original amount of money and does not change over time. For example, if you borrow $100 for one year at a 10% interest rate, you will pay back $110 at the end of the year. The interest is $10, which is 10% of $100. It does not matter how many times you pay back the loan during the year, the interest will always be $10. Simple interest is different from compound interest, which adds the interest earned to the principal amount and calculates the interest on the new amount every time period. Compound interest makes the interest grow faster than simple interest. For example, if you borrow $100 for one year at a 10% interest rate and pay back the loan every month, you will pay back $110.52 at the end of the year. The interest is $10.52, which is more than 10% of $100. This is because the interest is calculated on the remaining balance every month, which increases as you pay back the loan. Compound interest is more common than simple interest in real life, as most banks and financial institutions use it to calculate interest on loans, deposits, and investments.

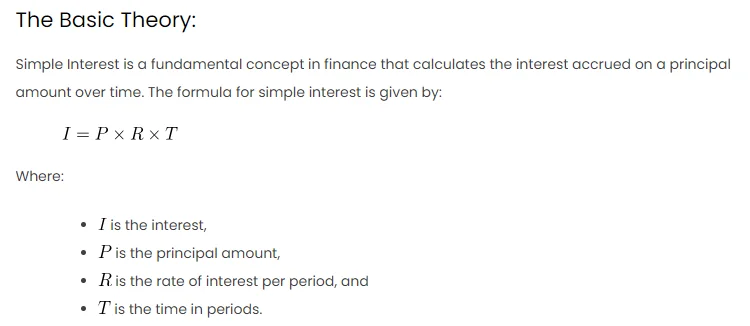

The Basic Theory:

Simple Interest is a fundamental concept in finance that calculates the interest accrued on a principal amount over time. The formula for simple interest is given by:

Where:

is the interest,

is the principal amount,

is the rate of interest per period, and

is the time in periods.

Procedures for Simple Interest Calculation in Excel:

- Set Up Your Excel Sheet:

- In cell A1, label it as “Principal.”

- In cell A2, label it as “Rate.”

- In cell A3, label it as “Time.”

- In cell A4, label it as “Simple Interest.”

- Enter your values in cells B1, B2, and B3 for principal, rate, and time, respectively.

- Use the Simple Interest Formula:

- In cell B4, enter the formula

to calculate the simple interest.

- In cell B4, enter the formula

- Format Your Sheet:

- Format cells as needed (currency, percentage, etc.) for a better presentation.

Comprehensive Explanation and Scenario:

Consider a scenario where you invest $5,000 at an annual interest rate of 4% for 3 years.

| A | B | |

|---|---|---|

| 1. Principal | $5,000 | |

| 2. Rate | 4% | |

| 3. Time | 3 years | |

| 4. Simple Interest | =B1*B2*B3 |

Calculation and Result:

Simple Interest

The result in cell B4 will show $600 as the simple interest earned over the specified time.

Other Approaches:

- Using Formulas:

- You can use the built-in Excel functions like

=PMT(rate, nper, pv)to calculate the payment for a loan or investment.

- You can use the built-in Excel functions like

- Data Tables:

- Excel allows you to create data tables to analyze how changing one or two variables can affect the result.

- Charts:

- Visualizing the impact of changes in principal, rate, or time can be achieved through charts.