An annuity due is a financial arrangement characterized by a series of periodic payments or receipts that occur at the beginning of each period. In contrast to ordinary annuities, where payments happen at the end of each period, annuities due involve cash flows at the outset of each interval. This structure is commonly encountered in various financial scenarios, including lease payments, certain types of investments, and loan repayments. The essence of an annuity due lies in its regularity, with equal amounts transacted at the commencement of each period. Understanding and calculating the present value of an annuity due is crucial for financial planning and analysis, providing insights into the current value of a stream of cash flows received or paid at the beginning of successive time periods.

Basic Theory

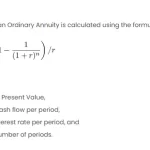

An annuity due is characterized by cash flows occurring at the beginning of each period. The formula to calculate the present value of an annuity due is given by:

Where:

is the present value of the annuity due,

is the payment amount,

is the interest rate per period, and

is the total number of periods.

Procedures in Excel

To calculate the present value of an annuity due in Excel, you can use the PV function. The formula syntax is as follows:

=PV(rate, nper, pmt, [fv], [type])Where:

rateis the interest rate per period,nperis the total number of periods,pmtis the payment made each period (annuity payment),fvis the future value, andtypeis the timing of payments (0 for end of the period, 1 for the beginning).

Explanation

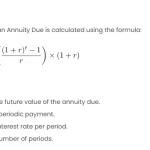

Let’s break down the formula components:

Where:

: The annuity payment made at the beginning of each period.

: The interest rate per period.

: The total number of periods.

This formula calculates the present value of the annuity due, providing the current value of a series of cash flows received or paid at the beginning of each period.

Scenario with Real Numbers

Consider a scenario where you invest $1,000 at the beginning of each year for 5 years with an annual interest rate of 6%.

Using the formula:

![Rendered by QuickLaTeX.com \[PV = \frac{1000 \times (1 - (1 + 0.06)^{-5})}{0.06}\]](https://excelcalculations.refrigeratordiagrams.com/wp-content/ql-cache/quicklatex.com-75e805efcabcf597ab8e80e1f5066d46_l3.svg)

Let’s perform the calculation in Excel:

=PV(0.06, 5, 1000, , 1)The result in Excel represents the present value of the annuity due.

Excel Table Explanation

Here’s an Excel table illustrating the scenario and the formula:

| Year | Payment | PV Factor | Present Value |

|---|---|---|---|

| 1 | 1000 | 0.9434 | 943.40 |

| 2 | 1000 | 0.8900 | 890.00 |

| 3 | 1000 | 0.8396 | 839.60 |

| 4 | 1000 | 0.7921 | 792.10 |

| 5 | 1000 | 0.7473 | 747.30 |

| Total | 4212.40 |

The total present value is $4,212.40.

Alternative Approaches

Apart from using the PV function, you can also use the annuity due formula with different Excel functions, such as SUM and FV (future value). However, the PV function is recommended for its simplicity and accuracy.