Perpetuities, in the realm of finance, are a unique form of cash flow characterized by a constant stream of payments that continue indefinitely. Unlike finite financial arrangements, such as annuities with a predetermined number of payments, perpetuities offer a consistent flow of funds at regular intervals that extend infinitely into the future. This financial concept is integral to various applications, including the valuation of certain bonds and dividends from stocks. The fundamental idea behind perpetuities lies in their perpetual nature, providing a stable and unending source of income. Investors and financial analysts often employ the concept when evaluating long-term investment opportunities, factoring in the perpetual cash flows to make informed decisions about the present value of these enduring financial streams.

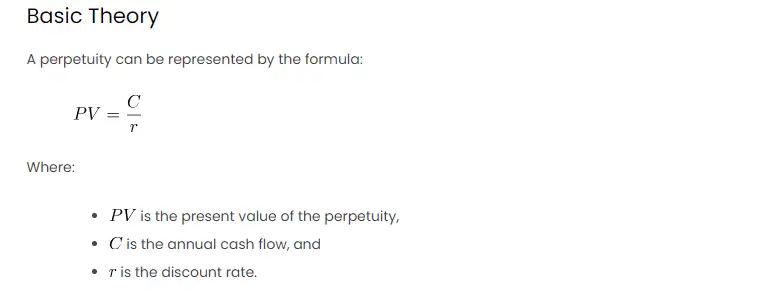

Basic Theory

A perpetuity can be represented by the formula:

Where:

is the present value of the perpetuity,

is the annual cash flow, and

is the discount rate.

The discount rate represents the required rate of return or the interest rate used to determine the present value

of future cash flows.

Procedures in Excel

Let’s use Microsoft Excel to calculate the present value of a perpetuity. Assume an annual cash flow () of

$1,000 and a discount rate () of 5%.

- Set Up Your Excel Sheet:

- Cell A1: “Cash Flow”

- Cell B1: “Discount Rate”

- Cell C1: “Present Value”

- Input Values:

- Cell A2: Enter the cash flow, e.g., $1,000

- Cell B2: Enter the discount rate, e.g., 5%

- Excel Formula:

- Cell C2: Enter the formula

=A2/B2

- Cell C2: Enter the formula

Explanation with Example

Let’s consider a scenario where you have invested in a perpetuity that promises an annual payment of $1,000, and you expect a 5% return on your investment.

| A | B | C | |

|---|---|---|---|

| 1 | Cash Flow | Discount Rate | Present Value |

| 2 | $1,000 | 5% | =A2/B2 |

The result in cell C2 will be $20,000. This means that the present value of receiving $1,000 per year indefinitely,

with a 5% discount rate, is $20,000.

Other Approaches

Using Excel Functions

You can also use Excel functions to calculate the present value of a perpetuity. Assuming the cash flow is in cell

A2 and the discount rate is in B2, you can use the following formula:

=PV(B2, 0, -A2)Scenario Analysis

To explore different scenarios, you can create a data table in Excel. Assume varying discount rates in column D

(e.g., 3%, 5%, 8%) and use the following formula in cell E2:

=PV(D2, 0, -A2)Drag this formula down, and you’ll get present values for different discount rates, allowing you to analyze the

impact of changing the discount rate on the perpetuity’s present value.