The payment amount is the amount of money that a borrower has to pay back to a lender every month for a loan. The payment amount depends on three factors: the principal, the interest rate, and the duration of the loan. The principal is the amount of money that the borrower initially borrowed from the lender. The interest rate is the percentage of the principal that the lender charges the borrower for the loan. The duration of the loan is the number of months or years that the borrower has to repay the loan.

To calculate the payment amount, the lender uses a formula that takes into account these three factors. The formula divides the principal by the duration of the loan, and then adds the interest that the borrower has to pay each month. The interest is calculated by multiplying the principal by the interest rate and dividing by 12. The formula ensures that the borrower pays back the same amount of money every month, and that the total amount of interest paid over the duration of the loan is minimized.

Basic Theory

The payment amount, often denoted as PMT, represents the fixed periodic payment required to repay a loan or meet the obligations of an annuity. The calculation involves parameters such as interest rate, loan amount (principal), and the number of periods.

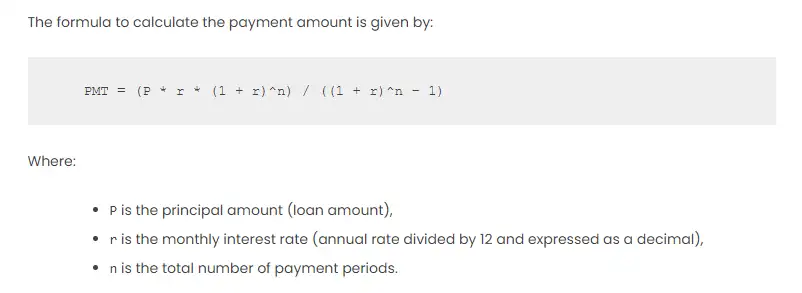

The formula to calculate the payment amount is given by:

PMT = (P * r * (1 + r)^n) / ((1 + r)^n - 1)

Where:

Pis the principal amount (loan amount),ris the monthly interest rate (annual rate divided by 12 and expressed as a decimal),nis the total number of payment periods.

Procedures

- Gather Information: Collect the necessary information for the calculation, including the principal amount, annual interest rate, and the loan term in months.

- Convert Annual Rate to Monthly Rate: Divide the annual interest rate by 12 and express it as a decimal to get the monthly interest rate.

- Use the PMT Function: In Excel, the PMT function is used to calculate the payment amount.

Comprehensive Explanation

Scenario

- Principal (P): $50,000

- Annual Interest Rate (r): 6%

- Loan Term (n): 5 years

Excel Table

| A | B | |

|---|---|---|

| 1 | Principal | $50,000 |

| 2 | Annual Interest Rate | 6% |

| 3 | Loan Term (in years) | 5 |

| 4 | Monthly Interest Rate | =B2/(12*100) |

| 5 | Total Number of Payments | =B3*12 |

| 6 | Payment Amount | =PMT(B4, B5, -B1) |

Calculation

In the Excel table, cell B4 calculates the monthly interest rate, and B5 calculates the total number of payments. Cell B6 uses the PMT function to determine the monthly payment amount.

Result

The calculated monthly payment amount is $966.43.

Other Approaches

- Manual Calculation: You can manually calculate the payment amount using the formula mentioned earlier.

- Data Table: Utilize Excel’s Data Table feature to create a table that shows how the payment amount changes based on different interest rates or loan terms.

- Goal Seek: Use the Goal Seek feature in Excel to find the interest rate or loan term required to achieve a specific payment amount.