The present value and the future value of money are two ways of measuring how much money is worth at different points in time. The present value is how much money you would need today to have the same amount of money in the future. The future value is how much money you will have in the future if you invest your money today.

The difference between the present value and the future value of money depends on the interest rate and the time period. The interest rate is how much money you can earn or pay by investing or borrowing money. The time period is how long you have to wait until you receive or pay money.

The higher the interest rate or the longer the time period, the bigger the difference between the present value and the future value of money. This means that money today is more valuable than money in the future, because you can use money today to earn more money in the future. This is the concept of the time value of money.

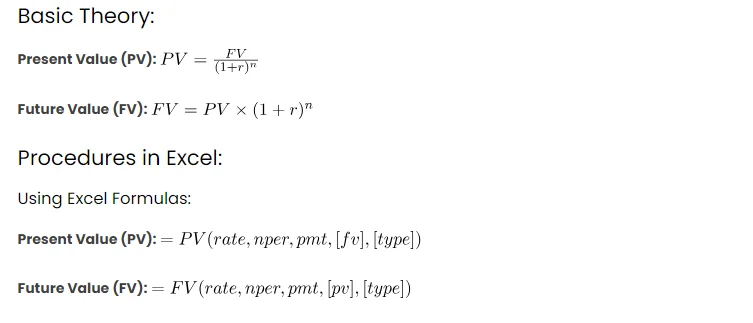

Basic Theory:

Present Value (PV):

Future Value (FV):

Procedures in Excel:

Using Excel Formulas:

Present Value (PV):

Future Value (FV):

Real-world Scenario:

Consider a scenario where you plan to invest $1000 per year for 10 years at an annual interest rate of 5%.

We want to determine both the present value and future value of this investment.

Excel Table:

| Year | Investment |

|---|---|

| 1 | -1000 |

| 2 | -1000 |

| 10 | -1000 |

Present Value Calculation:

Use the Excel formula: =PV(5%, 10, -1000, 0, 0)

Future Value Calculation:

Use the Excel formula: =FV(5%, 10, -1000, 0, 0)

Result:

Present Value: $7,722.58

Future Value: $13,585.90

Other Approaches:

- Data Tables: Excel’s data tables can display a range of outcomes by varying interest rates or periods.

- Goal Seek: Use the Goal Seek feature to find the interest rate or periods needed to reach a specific PV or FV.

- Scenario Manager: Excel’s Scenario Manager helps analyze different scenarios by changing multiple variables.